rhode island state tax rate

153 average effective rate. Rhode Island Tax Brackets Rates explained.

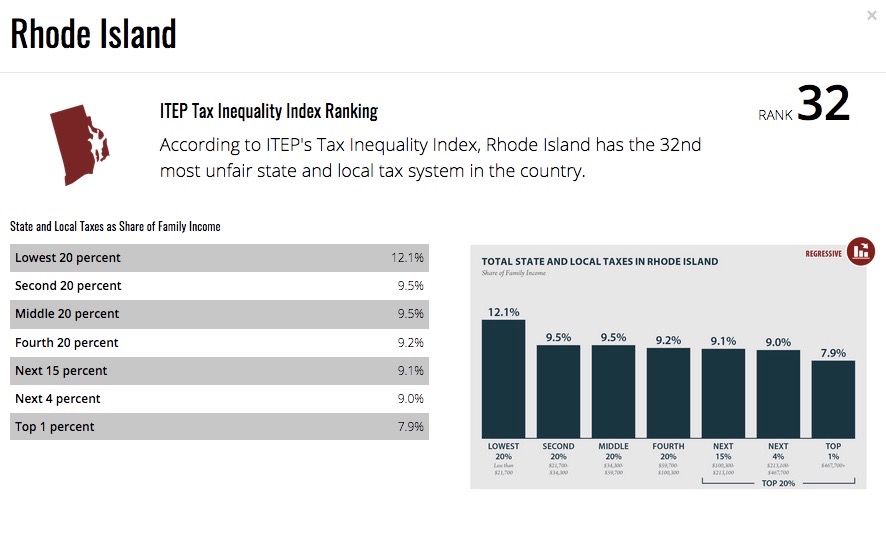

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children.

. Rhode Island State Married Filing Jointly Filer Tax Rates Thresholds and Settings. Rhode Island Towns with the Highest Property Tax Rates. Rhode Island income taxes are about average when compared to the rest of the country.

The current tax forms and tables should be consulted for the current rate. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. In Rhode Island the median property tax rate is 1571 per 100000 of assessed home value.

Rhode Island Income Tax Calculator 2021. Like most other states in the Northeast Rhode Island has both a. 34 cents per gallon of regular gasoline and diesel.

In 2011 Rhode Islands tax system underwent the most sweeping changes since the state tax was enacted in 1971. Rhode Island has a. Current and past tax year RI Tax Brackets Rates and Income Ranges.

The tax rates are progressive ranging from 375 to about. Rhode Island State Personal Income Tax Rates and Thresholds in 2022. The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax.

Most notable was the reduction of the top tax rate from 99 to. Your average tax rate is 1198 and your. West Greenwich has a property tax rate of 2403.

Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375. Sales tax rates remote seller nexus rules tax holidays amnesty programs and legislative updates. The estate tax threshold for Rhode Island is 1648611.

About Toggle child menu. If it is worth more than that there is a. Weve pulled in the.

Less than 100000 use the Rhode Island Tax Table located on pages T-2. The Rhode Island tax is based on federal adjusted gross income subject to modification. Providence has a property tax rate of 2456.

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. To calculate the Rhode Island taxable income the statute starts with Federal. Interest at the rate of 18 per and penalty at the rate of 05 per month to a maximum of 25 will start and continue to accrue from the date the tax is due until the tax due amount is paid.

For the 2022 tax year homeowners 65 and older with household income of. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income.

Rhode Island Tax Structure. State of Rhode Island Division of Municipal Finance Department of Revenue. If your estate is worth less than that you owe nothing to the state of Rhode Island.

Find sales and use tax information for Rhode Island. Rhode Island Income Tax Rate 2022 - 2023. Information on how to only file a Rhode Island State Income Return.

Central Falls has a property tax rate of. Rhode Island also has a 700 percent corporate income tax rate. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081.

Exemptions to the Rhode Island sales tax will vary by state.

How To Form An Llc In Rhode Island Llc Filing Ri Swyft Filings

Rhode Island S Funding Formula After Ten Years Education Finance In The Ocean State Rhode Island Public Expenditure Council

The Bluest State Decades Of Liberal Policies Have Made Rhode Island The Nation S Basket Case City Journal

Raising Revenues To Invest In Rhode Island Economic Progress Institute

Newport Councilors Target Higher Property Taxes For Short Term Rental Homeowners

Ri Kpi Briefing For Q2 2022 Rhode Island Experiences Employment Gains But Still Lags Nation In Recovery Of Jobs Lost During Pandemic Rhode Island Public Expenditure Council

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

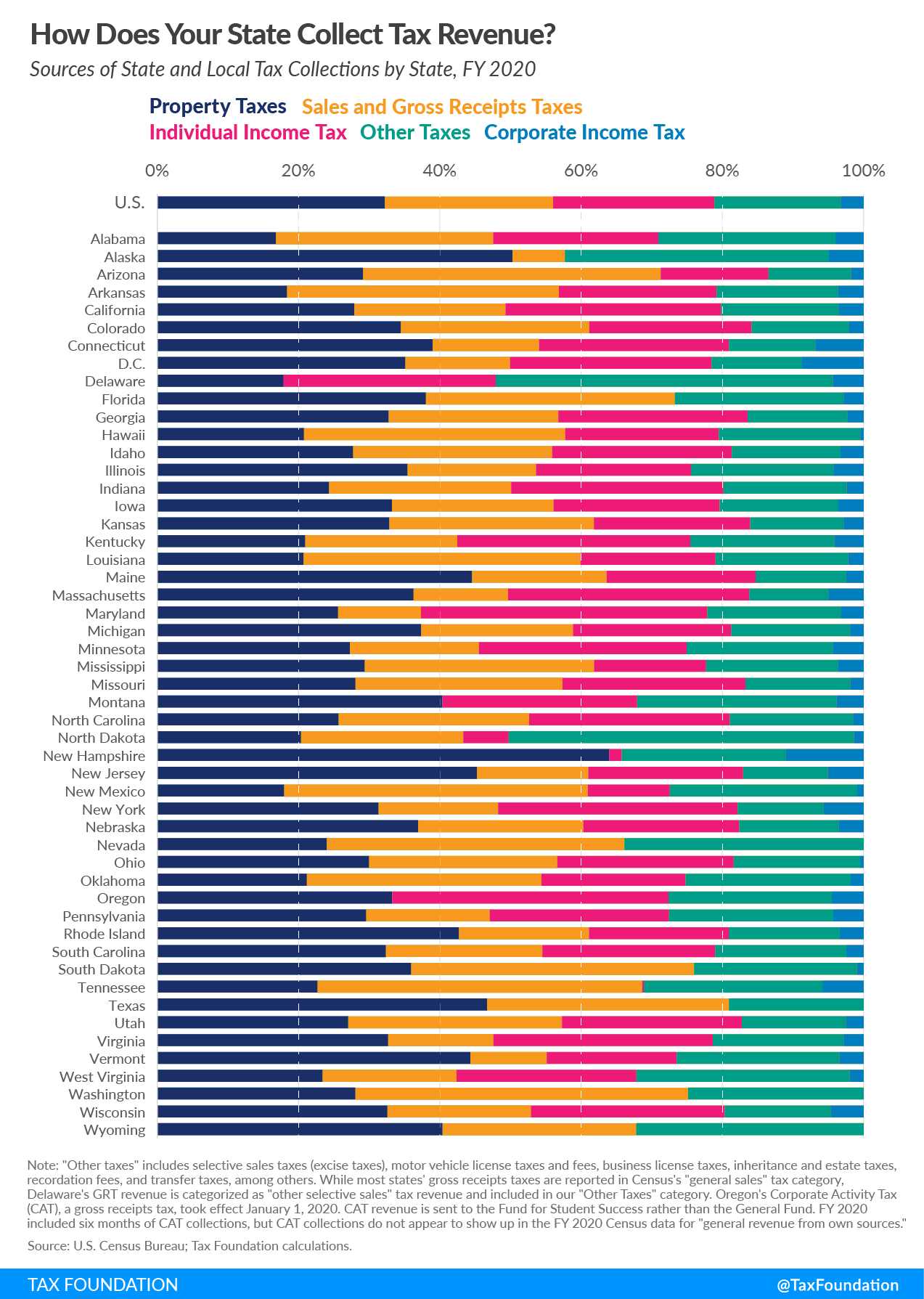

Tax Foundation R I Has 7th Highest Dependence On Property Taxes

Ri Health Insurance Mandate Healthsource Ri

States With The Highest Lowest Tax Rates

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Revenue For Ri Kicks Off Campaign To Tax The One Percent

Seven Things To Know About The R I House Finance Budget The Boston Globe

State Income Tax Rates And Brackets 2021 Tax Foundation

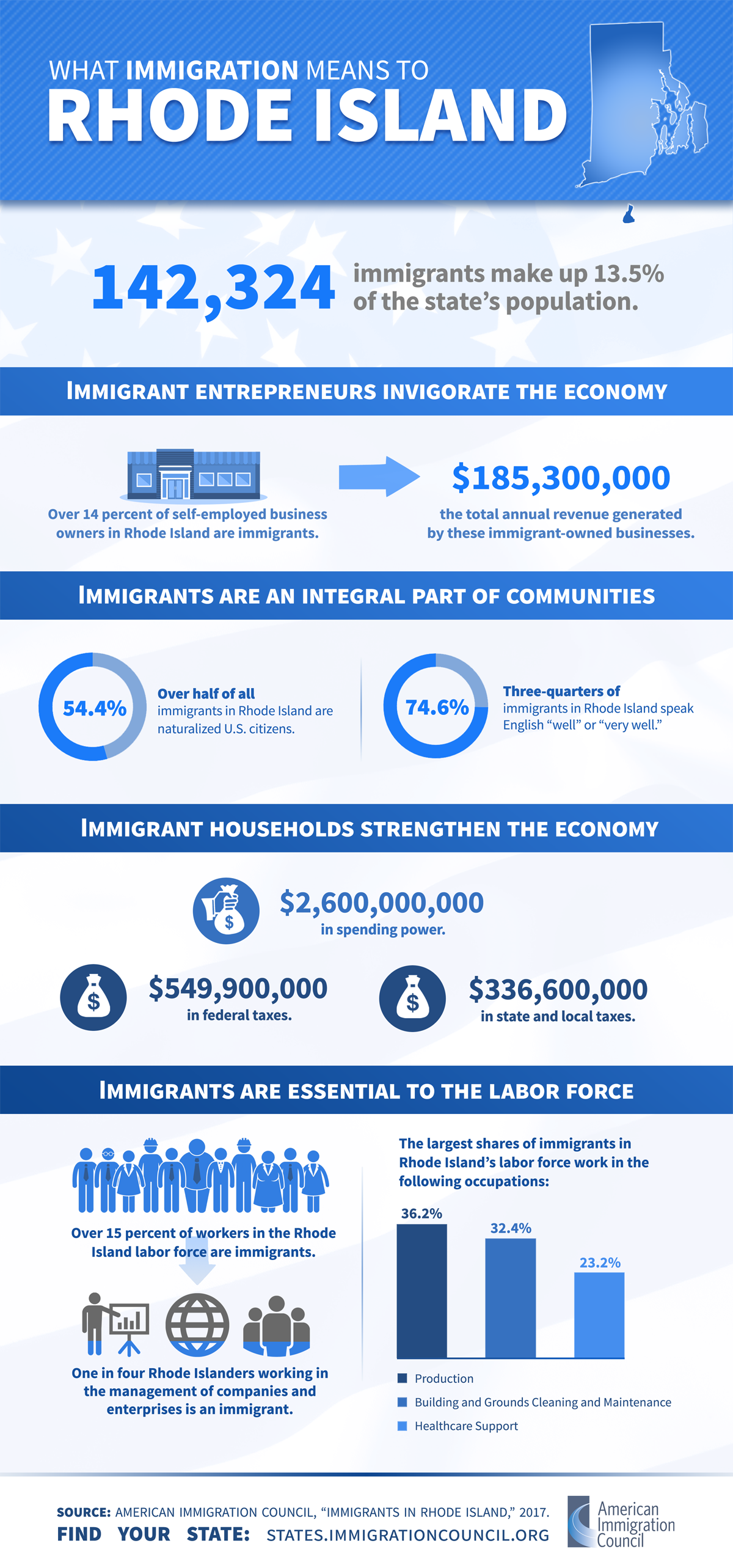

Immigrants In Rhode Island American Immigration Council

Opinion Murray Tax Hike On Wealthiest 1 Is Investment In Ri S Future

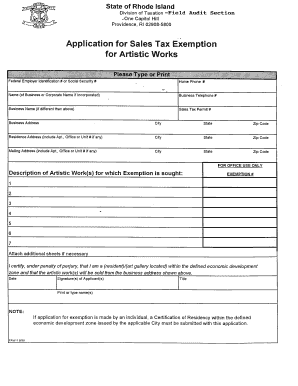

Rhode Island Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow